期货行情暴跌英语翻译

Market Plummet: Understanding the Recent Downturn

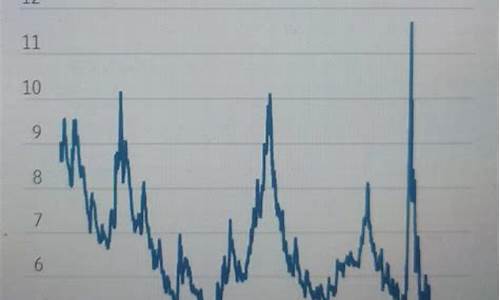

In recent days, the financial market has experienced a significant downturn, leaving investors anxious and uncertain about the future. This sudden drop in market prices has sent shockwaves through various sectors, impacting not only seasoned investors but also individuals with a stake in the market. Understanding the factors contributing to this downturn is crucial for navigating through these turbulent times.

Causes of the Downturn

Several factors have contributed to the recent market plunge. Economic uncertainty stemming from geopolitical tensions, fluctuating interest rates, and concerns about global trade dynamics has played a significant role. Additionally, unexpected events such as natural disasters or political unrest can exacerbate market volatility, leading to sudden declines in asset prices.

Impact on Investors

The downturn has left investors scrambling to protect their assets and minimize losses. Those heavily invested in equities may experience substantial declines in portfolio value, while others with diversified holdings may fare slightly better. However, the overall sentiment remains cautious as investors monitor market developments and adjust their strategies accordingly.

Navigating Through Uncertainty

During periods of market volatility, it's essential to stay informed and maintain a long-term perspective. Diversifying investments across different asset classes can help mitigate risks associated with market fluctuations. Additionally, maintaining a well-defined investment strategy and avoiding knee-jerk reactions to short-term market movements is crucial for long-term financial success.

In conclusion, while the recent downturn in the financial market has caused concern among investors, understanding the underlying causes and taking proactive steps to navigate through uncertainty can help mitigate risks and preserve wealth over the long term. By staying informed, diversifying investments, and maintaining a disciplined approach to investing, investors can weather market volatility and achieve their financial goals.